The global power battery TOP20

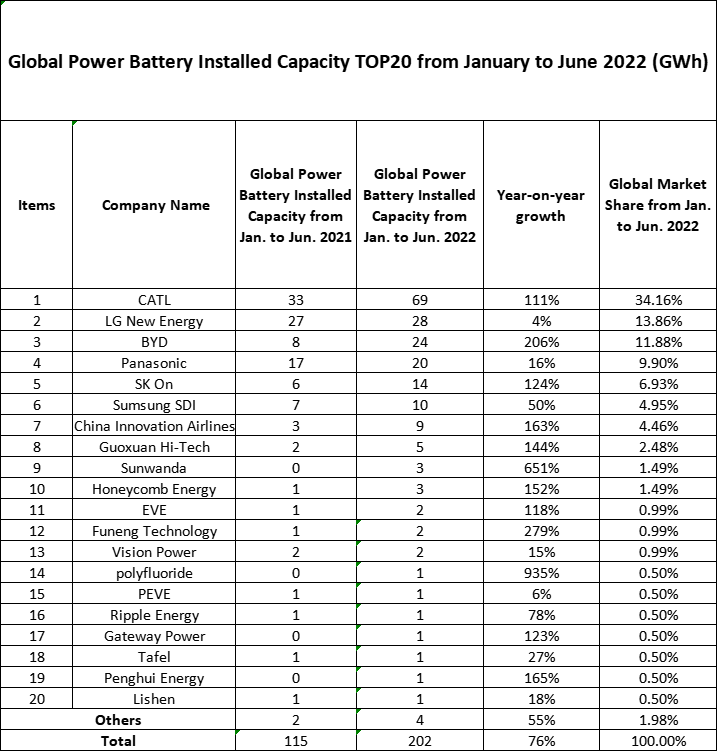

A report released by SNE Research, a South Korean market research institution, shows that from January to June 2022, the global installed capacity of power batteries will reach 202GWh, a significant increase of 75.65% from 115GWh in the same period last year.

From January to June, the top 20 companies in the global installed capacity of power batteries are: CATL , LG New Energy, BYD , Panasonic, SK On, Samsung SDI, China Innovation Aviation, Guoxuan Hi-Tech , Xinwangda , Honeycomb Energy, Yiwei Lithium Energy , Funeng Technology , Envision Power, Polyfluoride, PEVE, Ruipu Energy, Gateway Power, Tafel, Penghui Energy, Lishen did not even appear on the top 20 list.

Regarding the patent figures listed in these two reports, the author has no way to check the proportion of utility model patents and design patents, and even the statistics themselves cannot be verified. On the plus side, it is speculated that in addition to being flooded with a large number of design patents, Japanese companies may actually apply for patents for all technologies that are completed in corporate laboratories.

But this means a new problem. The essence of a patent is to disclose its own scheme and obtain protection through relevant laws. But this also means that in front of all the competitors in the world, he has shown his cards in advance. And because Japanese companies do not have extensive communication and technical exchanges with business rivals around the world, this move can be simply regarded as laying out patent barriers in advance.

Looking at the world, the main markets for new energy vehicles in the world are nothing more than China, the United States and Europe. In addition to the United States and Europe, China has also developed more competitive OEMs. This operation of Japanese companies is not so much to trap their opponents with patents, but to encircle themselves into the wall ahead of time.

Since the Japanese side has already made its mark, and historical experience tells you that this is a group of "iron roosters" who ignore the market conditions and their own status quo, and will not let go of intellectual property rights, then following the technical route they have circled is obviously a problem. The smartest choice for other players in the industry.

So, yesterday's history seems to be reappearing.

Fifteen years ago, Japan rashly deployed hydrogen energy across the country, and hid all the patents for hydrogen production, hydrogen storage and hydrogen fuel cell stacks; Do not let go, and are resolutely unwilling to share the vision of technology with peers.

▲ Toyota's famous planetary gear technology

As a result, the United States, Europe and China invariably ignored the hydrogen energy route and chose pure electricity in unison. As for those car companies that are also committed to hybrid vehicles, such as China's BYD and Japan's Honda, they are forced to spend huge sums of money to blaze their own path. In the end, the DM-i and iMMD with excellent performance are all parties to the "miser". The most powerful answer.

"The 17-inch large screen, the tactile feedback Yoke steering wheel, the gear shift is changed to the screen, the small screen in the back seat is very cute, the rear seat of the X is more comfortable, and the overall operation speed is really fast."

In early 2021, when Lin Zhiying got the latest three-motor version Model X full of joy, she never imagined that she and her youngest son would suffer this disaster more than a year later.

Just on the morning of last Friday (22nd), on Zhongzheng North Road, Taoyuan City, Taiwan, Lin Zhiying was driving his "1020 horsepower, 0-100km 2.1 second" performance monster, which he had been looking forward to, and ran into danger. territory.

Without warning, the moving vehicle suddenly veered to one side and slammed into the separation island in the center of the road.

From the surveillance video that came out later, we clearly understood the thrilling scene after:

Only 36 seconds after the impact, the Model X, which was once the representative of a luxury pure electric car, began to spew thick smoke and set off a raging fire.

Fortunately, just 6 seconds before the car detonated, Lin Zhiying and his son, who were knocked unconscious and trapped in the car, were dragged out of the wreckage by a group of passers-by who came to the rescue. The so-called "frozen age" Asian cyclone boy and his young son were slightly injured in the tragedy.

▲ The entire front body has been burned into "slag"

"The cause of the fire cannot be confirmed for the time being. In case of an emergency, the main and co-pilots have a mechanical door opening device, which can be forced to unlock the door in the event of a power failure, and the rear passengers can escape through the trunk."

Tesla's customer service said this in response to reporters' inquiries about the incident. At the same time, it also emphasized that there is no flammable material near the Tesla (car) driver's seat.

However, this is not the case, because just below the driver's seat, and even directly below the entire crew compartment, the 100kWh electric package that provides energy for the 1020-horsepower surging power of this 2.45-ton behemoth is here.

▲ Model X's "solid" chassis, the 100-degree battery pack accounts for more than half of the weight

The huge kinetic energy that hit the separation island instantly split the entire front of the car and broke the fragile shell of the electric pack. The leaking electrolyte caused a short circuit in a very short time, releasing a lot of thermal energy, which eventually ignited the entire front body.

The author can't imagine what kind of terrible fate the father and son in the car will usher in if the accident happened in a place where people are less traveled.

Whether based on safety or in pursuit of better vehicle performance, now is the time to seriously consider and plan for the commercialization of solid-state batteries.

If you pay attention to the new energy industry, you will find that the new forces in domestic car manufacturing are losing money.

Wei Xiaoli, Celis, Leapmotor, Nezha, etc. are all losing money, and they have lost a lot. As for other traditional car companies, the money they make on fuel vehicles is basically invested in new energy vehicles. up.

Therefore, Zeng Qinghong, chairman of GAC Group, complained: "The cost of power batteries has accounted for 40% to 60% of our cars. Am I not working for the Ningde era now?".

However, the Ningde era was also aggrieved, saying that he did not make any money. Although the company did not lose money and still made a profit, it was actually struggling. It was only a little profit, which was very painful.

So the question is, car companies say they can't make money, battery factories say they can't make money, and users also think that new energy vehicles are expensive, so who earns the money?

the new energy vehicle industry chain, we divide it according to the battery industry chain. There are upstream raw material suppliers, such as Tianqi Lithium and Ganfeng Lithium . The midstream is the battery factory, such as CATL and BYD . Downstream, there are car manufacturers such as Wei Xiaoli and Celis.

In addition, new energy vehicles also have various parts supply chains, such as core technology providers such as autonomous driving technology, chips, and lidar.

Let’s start with the battery industry chain. In the past few years, due to the outbreak of market demand, various lithium ore resources and battery materials have indeed exploded. The most typical one is that lithium carbonate has soared from more than 50,000 yuan per ton to the current more than 460,000 yuan per ton. Yuan.

Therefore, the upstream lithium mine suppliers can make a lot of money, and the Ningde era, as a midstream supply chain, is indeed helping the upstream material factories. Not enough.

For car companies, on the one hand, it bears the cost of rising battery prices, and on the other hand, it also bears the cost of rising chip prices.

You must know that the price of automotive chips has also risen sharply in the past two years, especially for some chips that are in short supply.

The chips required for new energy vehicles are several times that of traditional fuel vehicles, so the price of chips has also risen, and chip factories and wafer factories have also made money.

As a result, the price of new energy vehicles increased. After users bought them at a high price, the car companies did not make any money, and the battery factories did not make any money. In the end, everyone helped the most upstream lithium mines and chip factories to work.

From January to June, the global power battery TOP20 is released: 15 Chinese companies are on the list!

A report released by SNE Research, a South Korean market research institution, shows that from January to June 2022, the global installed capacity of power batteries will reach 202GWh, a significant increase of 75.65% from 115GWh in the same period last year.

From January to June, the top 20 companies in the global installed capacity of power batteries are: CATL , LG New Energy, BYD , Panasonic, SK On, Samsung SDI, China Innovation Aviation, Guoxuan Hi-Tech , Xinwangda , Honeycomb Energy, Yiwei Lithium Energy , Funeng Technology , Envision Power, Polyfluoride, PEVE, Ruipu Energy, Gateway Power, Tafel, Penghui Energy, Lishen.

Data source: SNE Research, Veken.com lithium battery tabulation

As can be seen from the above table, except Panasonic and Toyota subsidiary PEVE are Japanese companies, LG New Energy/SK On/Samsung SDI are Korean companies, the remaining 15 companies are all from China!

Judging from the market share of the TOP20, two Japanese companies have a total of 10.40%; three Korean companies have a total of 25.74%; 15 Chinese companies have a total of 61.88%.

Compared with the semi-annual and annual rankings in 2021 and 2020, the gap between the top two CATL and LG New Energy is getting bigger and bigger, while Panasonic has given up the third position and is surpassed by BYD.

It is worth mentioning that the gap between BYD and the second LG New Energy is not too big, and in the power battery installed capacity rankings in April and May, BYD has ranked second in the world above LG New Energy. !

Ningde era has obvious advantages

Since 2017, CATL has been the global power battery sales champion for five consecutive years.

From a closer look, CATL's global market share of power battery installed capacity in the first half of 2021 is 29%, which will increase to 32.6% in the whole of 2021, and in the latest first half of 2022, it will reach 34.16%.

Compared with the second-ranked LG New Energy, the market share of LG New Energy in the same period was 22.7%, 20.3% and 13.86% respectively. The gap is clearly growing.

On July 21, Zeng Yuqun, chairman of CATL, said at the 2022 World Power Battery Conference: " CATL's global market share reached 34% in the first half of this year. At present, CATL's products have covered 55 countries and regions around the world. Battery shipments have exceeded 400GWh, and one out of every three electric vehicles in the world is equipped with a CATL battery."

There is a phenomenon that among the top 20 car companies in terms of cumulative installed capacity in 2022, all except BYD are CATL customers, and in terms of share, mainstream car companies including Weilai, Ideal, and North and South Volkswagen are all exclusive suppliers . Pull , Geely, Xiaopeng, Changan, SAIC, etc. are the main suppliers, and the quality and share of customers are significantly better than those of their peers.

LG New Energy's net profit plummeted 85.7% in the first half of the year

When the global market share is retreating again and again, the performance of LG New Energy is not optimistic.

On July 27, LG New Energy released a financial report showing that the net profit in the second quarter of this year was 89.9 billion won, a year-on-year decrease of 85.7%; the operating profit was 195.6 billion won, a year-on-year decrease of 73%. LG New Energy said that the reason for the decline in profits was the continued disruption of the global supply chain.

Since LG New Energy has raised US$11 billion through its IPO in January this year, after its listing, it is using more funds and ammunition to expand production. Therefore, LG New Energy is still optimistic about the future. For example, at the second-quarter results conference, LG New Energy announced its mid-to-long-term strategic development plan and set a goal of triple revenue growth and double-digit operating profit margins in the next five years.

However, LG New Energy is slow. Not to mention the twists and turns of the US factory, its layout of the mainstream technical route of lithium iron phosphate batteries does not seem to be as smooth as it was originally planned:

Lithium iron phosphate battery technology at the Daejeon Laboratory in South Korea at the end of 2020, and is expected to build a pilot line in 2022 at the earliest.

Batteries from October 2023

As of July 27, LG New Energy finally announced that it plans to produce lithium iron phosphate batteries at LG China's factory in 2023.

Industry analysts pointed out that the penetration rate of lithium iron phosphate in the field of power batteries continues to increase, and Tesla and other car companies have also shifted their focus to the lithium iron phosphate route. In order to increase market share and maintain existing customers, LG New Energy must further Layout lithium iron phosphate battery.

More lithium battery companies show their magical powers

BYD is in the limelight, thanks to the hot sales of BYD 's new energy vehicles : in the first half of 2022, BYD surpassed Tesla to become the world's most sold new energy vehicle brand with 647,000 vehicles.

Due to the accumulation of many orders, BYD's hot sales of new energy vehicles in the second half of this year will also be the norm, and will sell more and more. What restricts BYD is currently only a production capacity issue. Correspondingly, BYD's installed capacity of power batteries will continue to rise.

Judging from the year-on-year growth rate, there are as many as 12 companies that have achieved an increase of more than 100%, namely DFD, Xinwangda, Funeng Technology, BYD, Penghui Energy, China Innovation Aviation, Honeycomb Energy, Guoxuan Hi-Tech, SK On, Gateway Power, Yiwei Lithium Energy, CATL. Of the 12 companies mentioned above, except SK On, which is a Korean company, the remaining 11 companies are all Chinese companies.

Polyfluoride has the fastest growth rate with a year-on-year growth rate of 935%. The reason for this is that the base of the battery installed capacity in the same period last year was relatively small, so the company currently ranks 14th. Its rapid development has made the market admirable.

Summarize

The power battery market will continue to grow in the future. On July 21, Ouyang Minggao, an academician of the Chinese Academy of Sciences, said at the World Power Battery Conference that in 2021, the investment in China's power batteries has exceeded one trillion yuan, and the production capacity will expand to 1,000 GWh; in 2025, China's power battery shipments will enter the TWh era. The output value will also enter the trillion level. This is only the Chinese market.

Of course, the development of the power battery industry is also facing great challenges. Dong Yang, chairman of the China Automotive Power Battery Industry Innovation Alliance, pointed out that the unstable epidemic situation has caused uncertain effects , the rise in the prices of raw materials and four main materials has led to rising battery costs, the shortage of power battery chips has led to prolonged battery pack supply cycles, and low carbon Factors such as development testing the ability of enterprises to integrate the supply chain cannot be underestimated.

Opportunities and challenges coexist, and the competition in the future power battery market will still be very fierce!

전편 :

세계 2위의 배터리 거두가 유럽에서 확장하다다음 편 :

배터리 업계 종사자들의 초조© Copyright: 화걸 All Rights Reserved. sitemap.html | sitemap.xml | 서비스 약관 | 프라이버시 조항